What Every Legacy-Minded Family Needs to Know and Do

As a high-net-worth individual, you understand that wealth is not simply numbers on a screen; it is the preservation of control, the expansion of options, and the quiet stewardship of a legacy in an increasingly volatile world. But what happens when the systems that support civil society, energy, communication, security, food, and finance suddenly cease to function as expected?

Many national-security professionals now agree: the United States is dangerously under-prepared for a prolonged national emergency. Emphasizing long-term planning reassures high-net-worth individuals that proactive strategies can safeguard their assets and legacy during extended infrastructure failures.

The Fragility of Modern Infrastructure

Our society relies on a just-in-time model for electricity, food, fuel, water, and medicine, making awareness of these vulnerabilities essential for legacy preservation and crisis preparedness.

Electric Grid Dependency

Military installations are 99 % reliant on the civilian power grid. Most backup generators last only 72 hours. In a prolonged outage, bases and civilian communities alike lose power – literally and figuratively.

Critical Service Collapse

Electricity powers water treatment plants, fuel pumps, internet servers, ATM networks, refrigeration, and emergency dispatch centers. When it fails, every modern convenience and every critical need fail with it. This is not theoretical. Cyberattacks on energy grids are rising. Solar activity is peaking in the current cycle. Both domestic and foreign actors have demonstrated the capability and intent to disrupt national infrastructure. The 2003 Northeast blackout lasted nearly four days and was triggered by nothing more sinister than a software bug and overgrown trees. What is your plan if an outage lasts a week, two weeks, or a month?

Social Conflict & Economic Breakdown

In a prolonged disruption, the real danger is not technical failure alone; it is human behavior in the absence of order. The divide becomes visible when systems collapse, and the gap between those with resources and those without turns dangerous. Desperation, not ideology, drives conflict.

Psychological Collapse

History shows how quickly hunger erodes morality. From the Soviet famine to Venezuela’s ongoing crisis, scarcity breeds theft, violence, and worse. Americans, unaccustomed to sustained hardship, may break down faster than many expect.

Without the Rule of Law

In the absence of functioning police, courts, or emergency services, violence becomes the default currency. Criminal elements thrive in the vacuum, especially in urban and suburban zones. We are already seeing early indicators: organized retail theft rings operating with impunity, once-vibrant downtowns hollowed out by crime and disorder, and citizens in other nations – doctors, engineers, teachers reduced to scavenging to feed their families.

Mental Stress, Leadership, and Group Dynamics

Stress in a prolonged crisis is strategic, not merely emotional. Long-term deprivation alters brain chemistry: irritability, paranoia, and impaired judgment follow. Normalcy bias keeps many in denial too long, expecting a rescue that never arrives. Without pre-existing trust, leadership, and shared purpose, groups fracture; resources are hoarded or wasted; infighting erupts. Establishing leadership and loyalty before a crisis is the difference between a cohesive unit and chaos.

Political Exploitation in Crisis

Never underestimate how power consolidates during chaos. Emergency powers can suspend rights, restrict movement, or seize private assets “for the common good” as we observed in twenty-twenty. The move toward programmable digital currencies gives authorities new tools to track, limit, or freeze individual transactions. In past disasters, governments have confiscated food, fuel, and firearms. A future crisis could see “mandatory contribution” programs or martial law used to requisition privately held resources.

Protecting yourself and your family requires more than wealth; it requires foresight and action taken now.

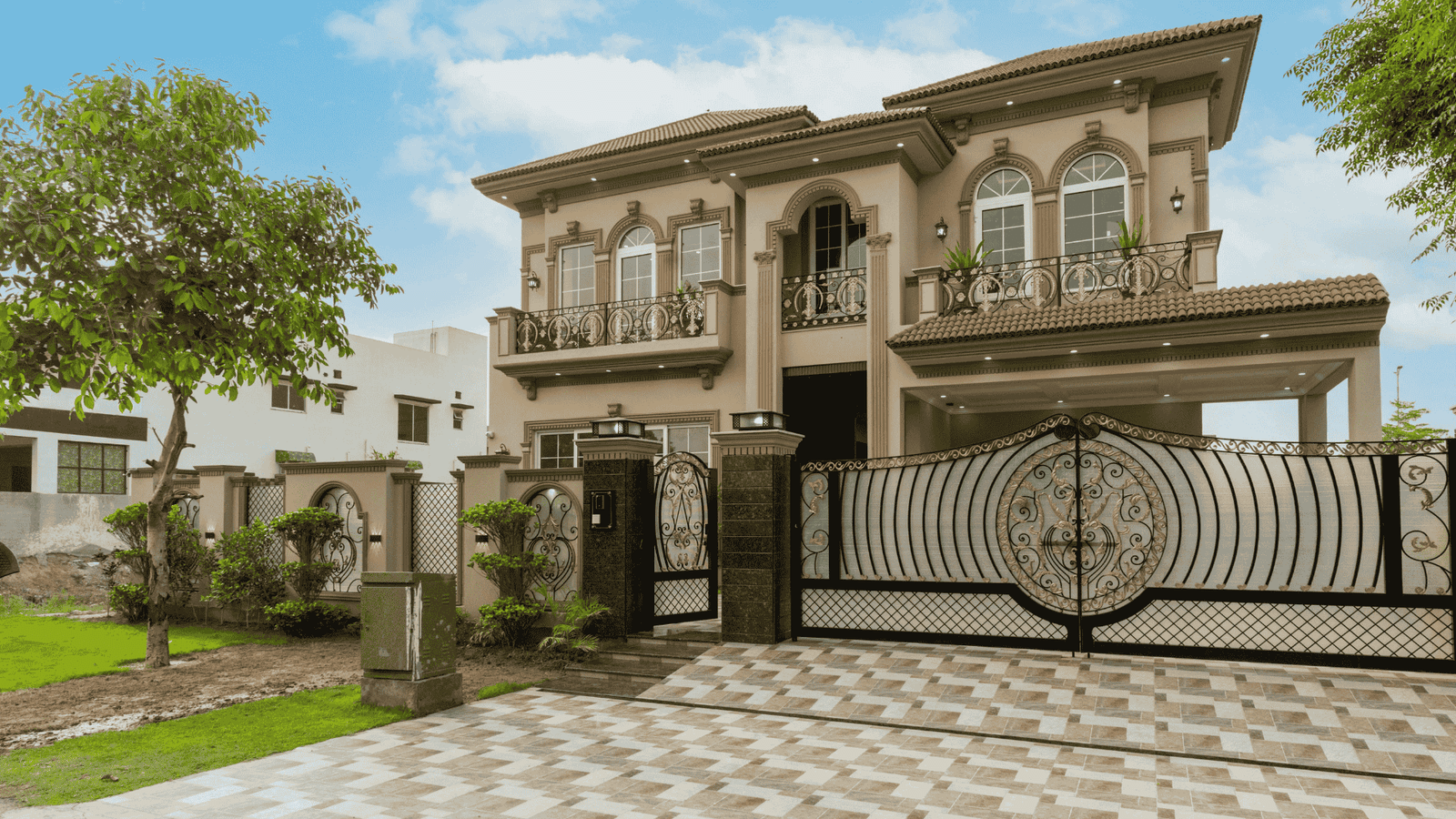

We begin with autonomous rural platforms: remote, low-visibility operating estates positioned well beyond 100 miles from major population centers. Each incorporates institutional-grade independent power generation, secure water sovereignty, and regenerative agriculture, supported by hardened perimeter systems, layered security, multi-year food reserves, seed banks, and on-site medical capability.

We aim to build a values-aligned micro-community of 10–20 individuals across 5–6 trusted family units. This fosters a sense of belonging and shared purpose, strengthening resilience and mutual support during crises.

Building financial sovereignty through diversification beyond traditional banking, using physical precious metals, offline digital assets, and coordinating across multiple jurisdictions requires proactive planning and expert guidance.

Finally, psychological and practical preparation completes the framework. Training in land management, first response, and crisis leadership, together with instilling responsibility—not just inheritance—in the next generation, creates a culture of adaptability, discipline, and mutual loyalty that endures long after any crisis has passed.

Final Thoughts

Preparedness is not fear; it is leverage. When others panic, those who have planned can protect, lead, and rebuild, giving you confidence in your ability to face future challenges.

The world is shifting. The infrastructure you rely on every day is far more fragile than most realize. But with the right platform, the proper jurisdiction, and the right people, you can not only endure a crisis but also emerge stronger. If you have decided the time to act is now, the next step is straightforward.

To ensure your family’s safety and legacy, securing a confidential consultation now is a crucial step toward comprehensive preparedness planning.

Important Disclosure

This publication is for general informational purposes only and reflects the author’s personal perspective. It is not financial, investment, tax, legal, or professional advice of any kind, nor an offer or solicitation. Calculated Risk Advisors disclaims all liability for actions taken or not taken based on this content. Readers should consult their own qualified advisors before making decisions.

© 2025 Calculated Risk Advisors. All rights reserved.

0 Comments